A proven strategy to increase portfolio company valuation by millions — without top-line growth or operational disruption

Unlock Hidden EBITDA from B2B Card Fees. Credit card processing is often treated as a back-office necessity — just another cost of doing business.

But for private equity firms, it can be a quiet lever to increase EBITDA and valuation across B2B-focused portfolios. This area is almost always overlooked — yet holds millions in hidden, recoverable value for those who know where to look.

Real Results

These are just a few examples of how portfolio companies can Unlock Hidden EBITDA from B2B Card Fees — by fixing structural inefficiencies. One portfolio company processing $300,000/month in card volume reduced fees by 43%, saving $144,000 annually. That one change increased the company’s enterprise value by more than $5 million.

Another B2B firm is saving over $150,000 per month in unnecessary interchange fees — more than $1.8 million annually. At common exit multiples, that translates to an estimated $15 to $20 million in added enterprise value. And that’s just one company, before applying this across a portfolio.

These aren't outliers. This is happening right now inside companies that look just like yours. Multiply these improvements across 5, 10, or 15 portfolio companies, and you’re looking at tens of millions in enterprise value currently being left on the table due to overlooked payment inefficiencies

What Most Firms Miss

Most businesses assume they’re set up correctly. In reality, even small oversights in the configuration are quietly costing them six to seven figures each year.

Let’s Take a Look

We offer a confidential second set of eyes to see what might be left on the table.

If there’s nothing, you’ll have peace of mind.

If there is — it could mean millions in missed EBITDA and untapped enterprise value.

Why This Gets Missed — and Why It Matters

The payments industry has virtually no regulation.

There are no licensing requirements, certifications, or oversight — which means just about anyone can sell merchant services, regardless of experience.

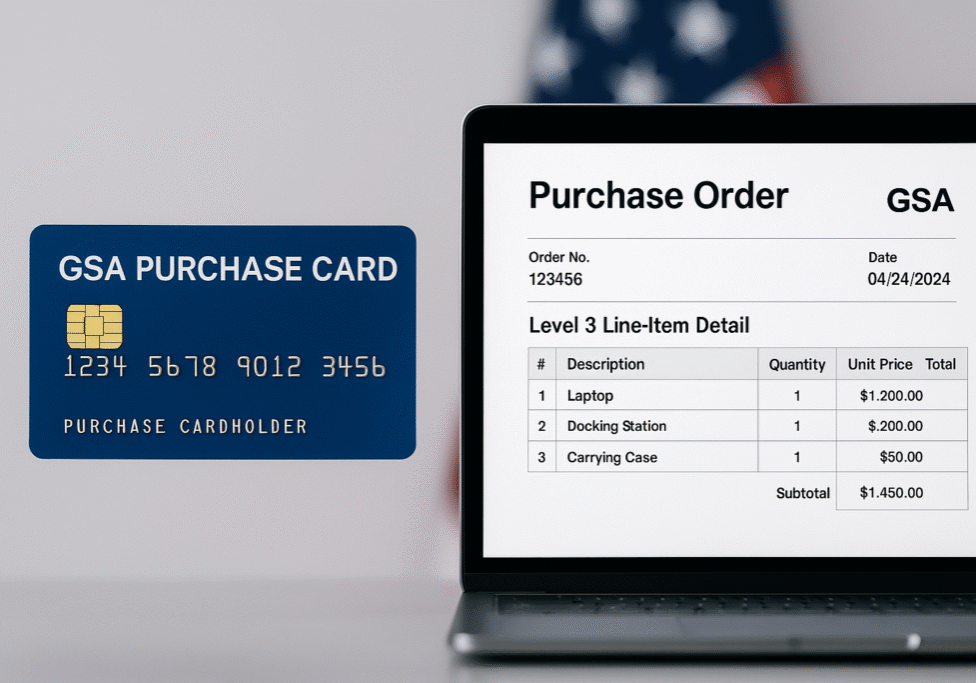

Even if someone has good intentions and is genuinely trying to do a good job, a lack of deep knowledge around interchange structure and qualification could be costing your company — or your portfolio — millions. For reference, Visa and MasterCard, publishes a simplified interchange table here, though its only a condensed version of the actual interchange system. In reality, there are over 1,000 unique interchange categories, many of which depend on how B2B transactions are configured — and most businesses (and processors) never optimize beyond the defaults.

That’s a serious issue when your portfolio companies are processing large commercial, B2B, or government payments. These aren't minor technicalities. They're structural inefficiencies that impact EBITDA, cash flow, and exit valuations.

What This Means for Private Equity

Embedded Payments: A Hidden Revenue Source

Most portfolio companies that process payments through their software are unknowingly giving up a valuable recurring revenue stream.

In many cases, their payment provider keeps the majority of the interchange revenue instead of sharing it back with the company.

By restructuring how payments flow through the business, firms can participate in that revenue — turning every transaction into a source of high-margin, recurring income that directly improves EBITDA and enterprise value.

At Revolution Payments, we help PE firms:

-

Identify whether portfolio companies are capturing the full economic value of their embedded payments

-

Quantify the recurring revenue opportunity available within their existing payment volume

-

Implement structures that retain more interchange income without changing how customers pay

If your portfolio companies already process payments through a platform or software system, we can evaluate whether they’re capturing all available revenue — or leaving millions on the table.

Partner with us today

and experience the difference.

Revolutionize your payment processing with Revolution Payments.