Revolutionize Your B2B Credit Card Processing: Optimize Costs, Maximize Savings

At Revolution Payments, we prioritize providing robust B2B Credit Card Processing solutions tailored for commercial transactions. Whether you deal with businesses or government agencies, a B2B merchant account is your gateway to unmatched benefits.

Commercial Card Expertise:

Understanding the unique demands of commercial transactions, our B2B merchant account supports various card types, including commercial, business, purchase cards, fleet cards, and GSA SmartPay cards. This flexibility ensures that your business is equipped to handle diverse payment methods efficiently.

Navigating Interchange Rates:

Visa and MasterCard set interchange rates that impact what you pay for credit card acceptance. Gaining insight into these rates and associated fees is key to gaining a significant edge. Our expertise allows us to guide you through this intricate landscape, resulting in substantial fee reductions for your business.

Exclusive B2B Merchant Account Benefits:

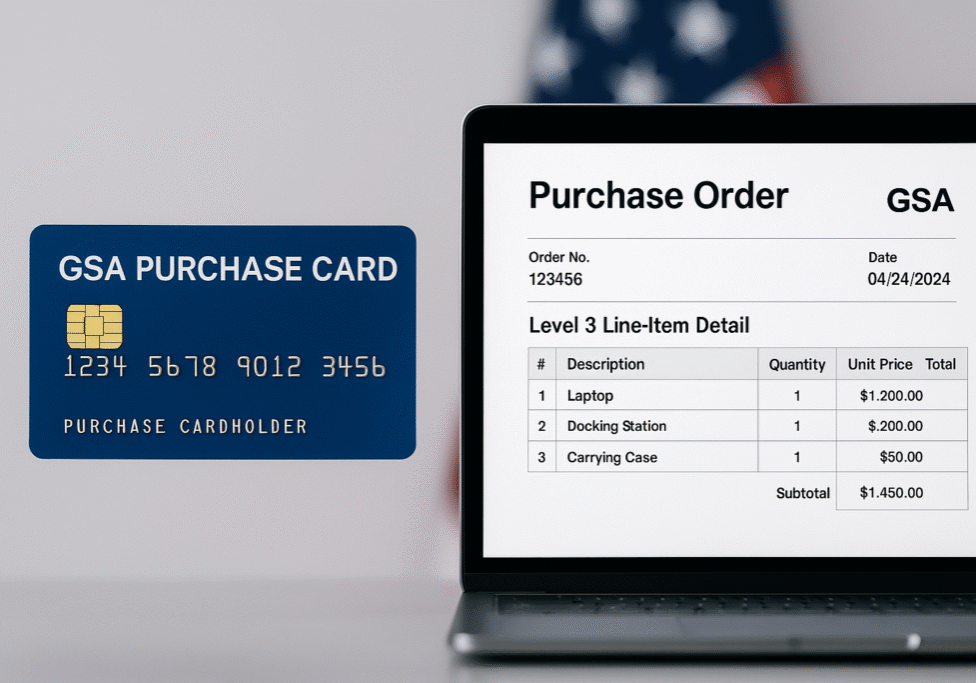

Unlock the lowest rates available with a dedicated B2B merchant account. While a low processing rate is crucial, up to 90% of total fees can stem from interchange charges. Reclassifying your B2B transactions to level II or level III interchange rates allows you to reclaim a substantial portion of interchange revenue.

Detailed Interchange Rate Breakdown:

Explore our B2B Interchange Rates, where we break down categories and present potential savings. With our strategic approach, you can save an average of 0.45% on Level 2 Business Cards and up to 0.90% on Level 3 - Corp/Purch/Fleet Cards.

Optimized Commercial Data Rates:

Our solutions include optimized rates for various transactions, ensuring you get the best deal. From Corporate and Purchasing to Fleet and Data Rates, we navigate the intricacies of commercial card processing to maximize your savings.

Consultative Approach:

Work closely with our experienced B2B payment processing consultants to ensure your payment operations are set up correctly. Our focus is on qualifying your transactions at the most favorable rates, especially in card-not-present environments.

Benefit from Next Day Funding, Large Ticket Acceptance, and reclassification of commercial transactions to lower interchange. With Level 2 and Level 3 credit card processing, dedicated account management, and transparent interchange pricing, our solutions are designed to meet your unique needs.

No Hidden Fees, Just Savings:

Enjoy the assurance of no cancellation fees, and rest easy knowing that interchange fees are returned to you on cardholder credits.

Ready to elevate your B2B credit card processing?

Contact us for a personalized review today and experience the Revolution Payments advantage!