What is Level 3 processing?

Benefits of Level 3 Processing for B2B and B2G Transactions

-

Reduced Interchange Fees: Qualifying Level 3 transactions can save up to 1%–1.5% before processor markups.

-

Compliance with Government & Large Enterprises: Required or preferred in many B2B/B2G programs.

-

Enhanced Reporting & Potential Rebates: Richer data improves visibility and can support issuer rebate programs.

-

Large-Ticket Savings: High-value transactions may qualify for additional interchange reductions when Level 3 detail is included.

How Level 3 Data Significantly Reduces Credit Card Processing Fees

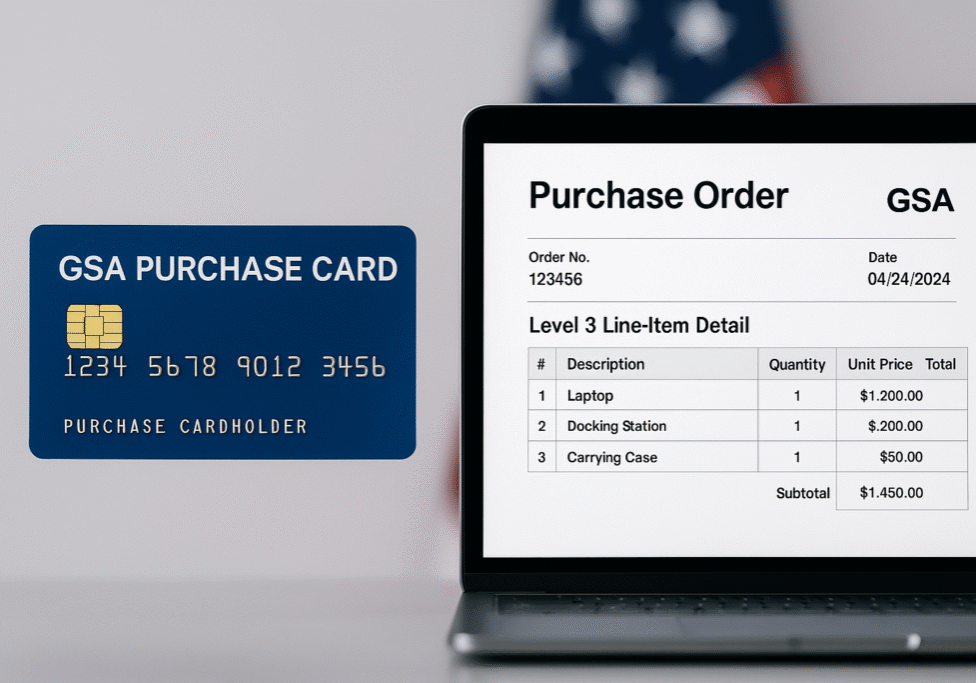

Eligible Cards

Cards eligible for level 3 processing are: purchase cards, corporate, government spending accounts, GSA SmartPay cards, fleet and MasterCard business cards.

How To Capture Level 3 Detail?

Qualifying for level 3 interchange rates requires a more sophisticated technology platform to capture what Visa and MasterCard refer to as level 3 processing (line item detail).

You need to adopt a virtual terminal capable of the additional line item detail Visa and MC require. Credit card terminals won’t cut it. They do not support the additional detail required to receive level 3 interchange rates.

Many companies are using equipment that is outdated along with bad practices when accepting commercial credit cards. Statistics show us that at least 3 out of 5 businesses are not set up to accept P-cards correctly, meaning they are not set up to process level 3-line item detail.

This unknowingly results in paying unnecessary high (interchange) processing fees. With greater and greater utilization of purchase, corporate, or government cards, it is now of even greater importance to properly manage your account and make sure your company is processing in the most economical manner.

Why You May Not Receive level 3 Interchange Rates!

Just sending Level 3 data does not guarantee Level 3 processing rates.

Visa and Mastercard require both:

-

The correct line-item data fields

-

The correct transaction configuration and settlement process

If either piece is missing or done incorrectly, the transaction will not qualify for Level 3 and can even downgrade to “Standard,” which can cost you 50–150 basis points more before your processor’s fee is even applied.

The three most common causes are:

-

Pre-authorizing and then settling for a higher amount

-

Not settling a transaction within 48 hours

-

Skipping the ZIP code field

Even if you have a good processor who’s trying to do a great job for you, this part of the process is often overlooked.

Accepting commercial or government cards without Level 3 line-item detail means you’re likely losing around 1% of revenue—and it has nothing to do with your processor’s rate.

Visa and Mastercard automatically apply higher interchange rates to any transactions that don’t meet Level 3 requirements, no matter how good your rate is.

Visa and MasterCard apply higher interchange rates for transactions that do not include level 3 payment detail.

Lower your interchange cost of accepting (B2B) Business-2-Business & (B2G) Business-2-Government credit card transactions by as much as 1%-1.5% with Level 3 processing.

The Hidden Costs of Inexperience

Interchange fees are rarely reviewed for accuracy, which means:

- Your business could be overpaying due to incorrect classifications.

- Rate changes (which typically occur in April and October) might not be accounted for.

- Lost revenue opportunities can go unnoticed due to lack of expertise.

Level 3 processing is the key to taking control of these fees, ensuring you pay the lowest possible rates while meeting strict interchange requirements.

Why Level 3 Processing Solves These Challenges

Level 3 processing not only reduces interchange fees but also ensures:

- Accuracy: Proper classification of transactions to avoid costly errors.

- Compliance: Adherence to updated interchange rules.

- Savings: Maximizing reductions in interchange rates, saving you up to 40%.

Visa and MasterCard each Publish their own interchange rates and talbes, which outline the base cost for every type of transaction. These tables are updated twice per year-typically in April and October.

View the official Visa U.S. Interchange rates here

View the official MasterCard U.S. interchange rates here

CLICK TO VIEW LARGER